Big Law's $1,000-Plus an Hour Club

Article

By VANESSA O'CONNELL

Leading attorneys in the U.S. are asking as much as $1,250 an hour, significantly more than in previous years, taking advantage of big clients' willingness to pay top dollar for certain types of services.

WSJ's Ashby Jones discusses how some of the nation's top attorneys are able to command huge fees despite the economy being weighed down by the recession.

A few pioneers had raised their fees to more than $1,000 an hour about five years ago, at the peak of the economic boom. But after the recession hit, many of the rest of the industry's elite were hesitant, until recently, to charge more than $990 an hour.

While companies have cut legal budgets and continue to push for hourly discounts and capped-fee deals with their law firms, many of them have shown they won't skimp on some kinds of legal advice, especially in high-stakes situations or when they think a star attorney might resolve their problem faster and more efficiently than a lesser-known talent.

Harvey Miller, a bankruptcy partner at New York-based Weil, Gotshal & Manges, said his firm had an "artificial constraint" limiting top partners' hourly fee because "$1,000 an hour is a lot of money." It got rid of the cap after studying filings that showed other lawyers surpassing that barrier by about $50.

See which attorneys had some of the highest-known hourly rates in 2010 and 2009.

$1,000 an Hour: 'If You Can Get It, Get It'

Today Mr. Miller and some other lawyers at Weil Gotshal ask as much as $1,045 an hour. "The underlying principle is if you can get it, get it," he said.

"Not many attorneys can command four figures hourly, and I do have trouble swallowing that," said Thomas L. Sager, general counsel at chemical maker DuPont Co. Still, he added, DuPont pays more than $1,000 an hour to a "select few," particularly for mergers-and-acquisitions advice.

Janine Dascenzo, associate general counsel of General Electric Co., GE -0.65% said that her company is willing to pay what it must when it needs a lawyer with "unique" expertise. "We'll keep paying them a lot of money, because they're worth that," she added.

Industrywide, attorneys in finance-related practices such as M&A, bankruptcy law and taxes, tend to command a premium to their peers in other specialties.

One of the priciest attorneys over the past year, according to court filings, has been Kirk A. Radke, whose specialty at Kirkland & Ellis LLP in New York is advising clients on leveraged buyouts and forming private-equity funds. As of early 2010, Mr. Radke, whose clients include private-equity firm Avista Capital Partners, had an hourly fee of $1,250.

Mr. Radke and Kirkland & Ellis declined to comment, as did Avista Capital.

[TOPRATESjp]

Such rates are contributing to inflation across the $100 billion-a-year global corporate-law industry as the slow economic recovery has left many law firms struggling to finance the hefty pay packages they award their stars. Since most law partners bill roughly 2,000 hours, those asking $1,100 hourly will bring in $2.2 million, a few million short of the $3 million or $4 million in annual compensation star attorneys get at many big firms.

To help fill the gap, the firms rely on the profit they often reap on the work of junior attorneys, or associates. Dozens of associates at a time can work on a single case, and some firms bill as much as $700 an hour for their time, according to Valeo Partners, a Washington consulting firm that maintains a database of hourly legal rates in fields such as litigation, corporate law and intellectual property.

That strategy can fuel tensions with clients. "We are much less willing to pay an army of associates at the ever-increasing rate," said GE's Ms. Dascenzo.

"Plenty of clients say to me, 'I don't have any problems with your rate,' " said William F. Nelson, a Washington-based tax partner at Bingham McCutchen, who commands $1,095 an hour, up from $1,065 last year. "But there is price pressure for associates, especially junior lawyers.

A small but growing number of top lawyers are using other arrangements in place of hourly billing. David Boies, chairman of Boies, Schiller & Flexner and a prominent trial lawyer, charges $960 an hour, a spokeswoman for the firm said. But just a third of his time is devoted to matters that are billed hourly. More often his deals with clients involve alternatives such as pegging fees to his success, she said.

More typically, big law firms' managing partners dictate hourly rates annually, often studying what their rivals charge, according to disclosures in their attorney-fee filings in corporate-bankruptcy cases, which provide a rare public peek at the industry. Such cases involve more than just bankruptcy lawyers; they frequently draw in a range of attorneys, including specialists in such areas as taxes, product liability and environmental and intellectual-property law.

This year, top litigators at Morgan, Lewis & Bockius LLP, a Philadelphia-based firm, are asking as much as $1,200 an hour. A spokeswoman for the firm said "less than 1% of our partners are at rates of $1,000 or more."

Gregory B. Craig, a former counsel to the Obama White House who joined Skadden, Arps, Slate, Meagher & Flom LLP a year ago as a Washington-based litigation partner, is asking $1,065 an hour, according to a court filing last month. Skadden Arps declined to comment. Mr. Craig didn't respond to a request for comment

M&A lawyer John M. Reiss, from White & Case in New York, started billing $1,100 an hour last year. "Some clients do focus on the hourly rate, but in the end what really matters is their total cost and whether they got a fair price," said Mr. Reiss.

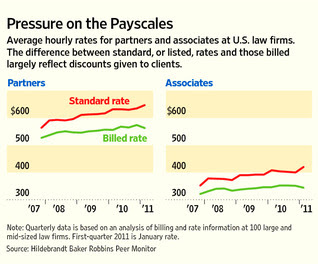

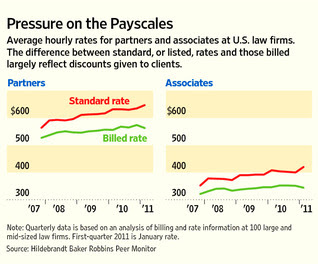

In recent years, pressure from clients for discounts has made it increasingly difficult for law firms to increase their lawyers' fees across the board. Hourly rates for partners rose by an average 3% in 2009 and 2010, and 2.3% this year, compared with an 8% increase in 2008, according to Hildebrandt Baker Robbins. The average law-firm partner now asks $635 an hour and bills $575, the firm said. But a small group of attorneys in some specialties command significantly more.

Nearly 2.9% of partners at a group of 24 large U.S. and British law firms asked for $1,000 an hour or more in U.S. cases last year, up from 1.5% in 2009, according to Valeo.

London-based lawyers have tended to charge higher per-hour rates than their U.S.-based counterparts. However, London attorneys typically don't bill as many hours on a case as do U.S. attorneys, some lawyers say.

"A thousand dollars an hour was a choke point for some clients," said Peter Zeughauser, a consultant to law firms. "I don't think there will be another significant psychological barrier until rates reach $2,000 an hour, which they will do, probably in five to seven years."

Write to Vanessa O'Connell at vanessa.o'connell@wsj.com

See which attorneys had some of the highest-known hourly rates in 2010 and 2009.

$1,000 an Hour: 'If You Can Get It, Get It'

Today Mr. Miller and some other lawyers at Weil Gotshal ask as much as $1,045 an hour. "The underlying principle is if you can get it, get it," he said.

"Not many attorneys can command four figures hourly, and I do have trouble swallowing that," said Thomas L. Sager, general counsel at chemical maker DuPont Co. Still, he added, DuPont pays more than $1,000 an hour to a "select few," particularly for mergers-and-acquisitions advice.

Janine Dascenzo, associate general counsel of General Electric Co., GE -0.65% said that her company is willing to pay what it must when it needs a lawyer with "unique" expertise. "We'll keep paying them a lot of money, because they're worth that," she added.

Industrywide, attorneys in finance-related practices such as M&A, bankruptcy law and taxes, tend to command a premium to their peers in other specialties.

One of the priciest attorneys over the past year, according to court filings, has been Kirk A. Radke, whose specialty at Kirkland & Ellis LLP in New York is advising clients on leveraged buyouts and forming private-equity funds. As of early 2010, Mr. Radke, whose clients include private-equity firm Avista Capital Partners, had an hourly fee of $1,250.

Mr. Radke and Kirkland & Ellis declined to comment, as did Avista Capital.

[TOPRATESjp]

Such rates are contributing to inflation across the $100 billion-a-year global corporate-law industry as the slow economic recovery has left many law firms struggling to finance the hefty pay packages they award their stars. Since most law partners bill roughly 2,000 hours, those asking $1,100 hourly will bring in $2.2 million, a few million short of the $3 million or $4 million in annual compensation star attorneys get at many big firms.

To help fill the gap, the firms rely on the profit they often reap on the work of junior attorneys, or associates. Dozens of associates at a time can work on a single case, and some firms bill as much as $700 an hour for their time, according to Valeo Partners, a Washington consulting firm that maintains a database of hourly legal rates in fields such as litigation, corporate law and intellectual property.

That strategy can fuel tensions with clients. "We are much less willing to pay an army of associates at the ever-increasing rate," said GE's Ms. Dascenzo.

"Plenty of clients say to me, 'I don't have any problems with your rate,' " said William F. Nelson, a Washington-based tax partner at Bingham McCutchen, who commands $1,095 an hour, up from $1,065 last year. "But there is price pressure for associates, especially junior lawyers.

A small but growing number of top lawyers are using other arrangements in place of hourly billing. David Boies, chairman of Boies, Schiller & Flexner and a prominent trial lawyer, charges $960 an hour, a spokeswoman for the firm said. But just a third of his time is devoted to matters that are billed hourly. More often his deals with clients involve alternatives such as pegging fees to his success, she said.

More typically, big law firms' managing partners dictate hourly rates annually, often studying what their rivals charge, according to disclosures in their attorney-fee filings in corporate-bankruptcy cases, which provide a rare public peek at the industry. Such cases involve more than just bankruptcy lawyers; they frequently draw in a range of attorneys, including specialists in such areas as taxes, product liability and environmental and intellectual-property law.

This year, top litigators at Morgan, Lewis & Bockius LLP, a Philadelphia-based firm, are asking as much as $1,200 an hour. A spokeswoman for the firm said "less than 1% of our partners are at rates of $1,000 or more."

See which attorneys had some of the highest-known hourly rates in 2010 and 2009.

$1,000 an Hour: 'If You Can Get It, Get It'

Today Mr. Miller and some other lawyers at Weil Gotshal ask as much as $1,045 an hour. "The underlying principle is if you can get it, get it," he said.

"Not many attorneys can command four figures hourly, and I do have trouble swallowing that," said Thomas L. Sager, general counsel at chemical maker DuPont Co. Still, he added, DuPont pays more than $1,000 an hour to a "select few," particularly for mergers-and-acquisitions advice.

Janine Dascenzo, associate general counsel of General Electric Co., GE -0.65% said that her company is willing to pay what it must when it needs a lawyer with "unique" expertise. "We'll keep paying them a lot of money, because they're worth that," she added.

Industrywide, attorneys in finance-related practices such as M&A, bankruptcy law and taxes, tend to command a premium to their peers in other specialties.

One of the priciest attorneys over the past year, according to court filings, has been Kirk A. Radke, whose specialty at Kirkland & Ellis LLP in New York is advising clients on leveraged buyouts and forming private-equity funds. As of early 2010, Mr. Radke, whose clients include private-equity firm Avista Capital Partners, had an hourly fee of $1,250.

Mr. Radke and Kirkland & Ellis declined to comment, as did Avista Capital.

[TOPRATESjp]

Such rates are contributing to inflation across the $100 billion-a-year global corporate-law industry as the slow economic recovery has left many law firms struggling to finance the hefty pay packages they award their stars. Since most law partners bill roughly 2,000 hours, those asking $1,100 hourly will bring in $2.2 million, a few million short of the $3 million or $4 million in annual compensation star attorneys get at many big firms.

To help fill the gap, the firms rely on the profit they often reap on the work of junior attorneys, or associates. Dozens of associates at a time can work on a single case, and some firms bill as much as $700 an hour for their time, according to Valeo Partners, a Washington consulting firm that maintains a database of hourly legal rates in fields such as litigation, corporate law and intellectual property.

That strategy can fuel tensions with clients. "We are much less willing to pay an army of associates at the ever-increasing rate," said GE's Ms. Dascenzo.

"Plenty of clients say to me, 'I don't have any problems with your rate,' " said William F. Nelson, a Washington-based tax partner at Bingham McCutchen, who commands $1,095 an hour, up from $1,065 last year. "But there is price pressure for associates, especially junior lawyers.

A small but growing number of top lawyers are using other arrangements in place of hourly billing. David Boies, chairman of Boies, Schiller & Flexner and a prominent trial lawyer, charges $960 an hour, a spokeswoman for the firm said. But just a third of his time is devoted to matters that are billed hourly. More often his deals with clients involve alternatives such as pegging fees to his success, she said.

More typically, big law firms' managing partners dictate hourly rates annually, often studying what their rivals charge, according to disclosures in their attorney-fee filings in corporate-bankruptcy cases, which provide a rare public peek at the industry. Such cases involve more than just bankruptcy lawyers; they frequently draw in a range of attorneys, including specialists in such areas as taxes, product liability and environmental and intellectual-property law.

This year, top litigators at Morgan, Lewis & Bockius LLP, a Philadelphia-based firm, are asking as much as $1,200 an hour. A spokeswoman for the firm said "less than 1% of our partners are at rates of $1,000 or more."

Gregory B. Craig, a former counsel to the Obama White House who joined Skadden, Arps, Slate, Meagher & Flom LLP a year ago as a Washington-based litigation partner, is asking $1,065 an hour, according to a court filing last month. Skadden Arps declined to comment. Mr. Craig didn't respond to a request for comment

M&A lawyer John M. Reiss, from White & Case in New York, started billing $1,100 an hour last year. "Some clients do focus on the hourly rate, but in the end what really matters is their total cost and whether they got a fair price," said Mr. Reiss.

In recent years, pressure from clients for discounts has made it increasingly difficult for law firms to increase their lawyers' fees across the board. Hourly rates for partners rose by an average 3% in 2009 and 2010, and 2.3% this year, compared with an 8% increase in 2008, according to Hildebrandt Baker Robbins. The average law-firm partner now asks $635 an hour and bills $575, the firm said. But a small group of attorneys in some specialties command significantly more.

Nearly 2.9% of partners at a group of 24 large U.S. and British law firms asked for $1,000 an hour or more in U.S. cases last year, up from 1.5% in 2009, according to Valeo.

London-based lawyers have tended to charge higher per-hour rates than their U.S.-based counterparts. However, London attorneys typically don't bill as many hours on a case as do U.S. attorneys, some lawyers say.

"A thousand dollars an hour was a choke point for some clients," said Peter Zeughauser, a consultant to law firms. "I don't think there will be another significant psychological barrier until rates reach $2,000 an hour, which they will do, probably in five to seven years."

Write to Vanessa O'Connell at vanessa.o'connell@wsj.com

Gregory B. Craig, a former counsel to the Obama White House who joined Skadden, Arps, Slate, Meagher & Flom LLP a year ago as a Washington-based litigation partner, is asking $1,065 an hour, according to a court filing last month. Skadden Arps declined to comment. Mr. Craig didn't respond to a request for comment

M&A lawyer John M. Reiss, from White & Case in New York, started billing $1,100 an hour last year. "Some clients do focus on the hourly rate, but in the end what really matters is their total cost and whether they got a fair price," said Mr. Reiss.

In recent years, pressure from clients for discounts has made it increasingly difficult for law firms to increase their lawyers' fees across the board. Hourly rates for partners rose by an average 3% in 2009 and 2010, and 2.3% this year, compared with an 8% increase in 2008, according to Hildebrandt Baker Robbins. The average law-firm partner now asks $635 an hour and bills $575, the firm said. But a small group of attorneys in some specialties command significantly more.

Nearly 2.9% of partners at a group of 24 large U.S. and British law firms asked for $1,000 an hour or more in U.S. cases last year, up from 1.5% in 2009, according to Valeo.

London-based lawyers have tended to charge higher per-hour rates than their U.S.-based counterparts. However, London attorneys typically don't bill as many hours on a case as do U.S. attorneys, some lawyers say.

"A thousand dollars an hour was a choke point for some clients," said Peter Zeughauser, a consultant to law firms. "I don't think there will be another significant psychological barrier until rates reach $2,000 an hour, which they will do, probably in five to seven years."

Write to Vanessa O'Connell at vanessa.o'connell@wsj.com